Reveal

Potential

Reach the heights of trading with us! We offer a wide range of trading accounts suitable for traders of all levels.

Get Started

First steps

How to Start Earning

1step

Think

Consider several ways to earn money on the exchange. Assess their advantages and disadvantages. Choose among them the most suitable for you.

2step

Choose

Find several tools on our platform for investing and choose among them the most suitable one. Register and open a minimum deposit.

3step

Earn and Learn

Try different approaches, learn from your actions, gain experience. Analyze your steps, work on your mistakes, improve your skills and strategies.

Features

Open a World of New Financial Opportunities

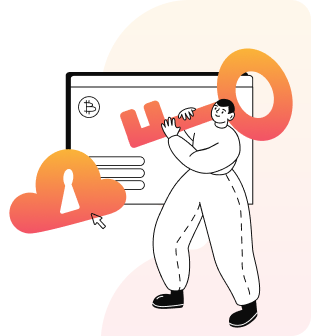

Investments

Explore a wide range of trading instruments, carefully selected for their high liquidity, allowing you to make optimal investment decisions.

Analytics

Gain access to exclusive market research empowering you to learn how to predict chart movements alongside our team of traders.

VIP Club

Join an international community of traders and unlock privileges that are typically unavailable to the majority of market participants.

Safety

The real-time margin calculation system reflects the market revaluation of all client positions, ensuring an accurate risk.

Explore a variety of options and trade with confidence, taking advantage of global market trends and making informed investment decisions.

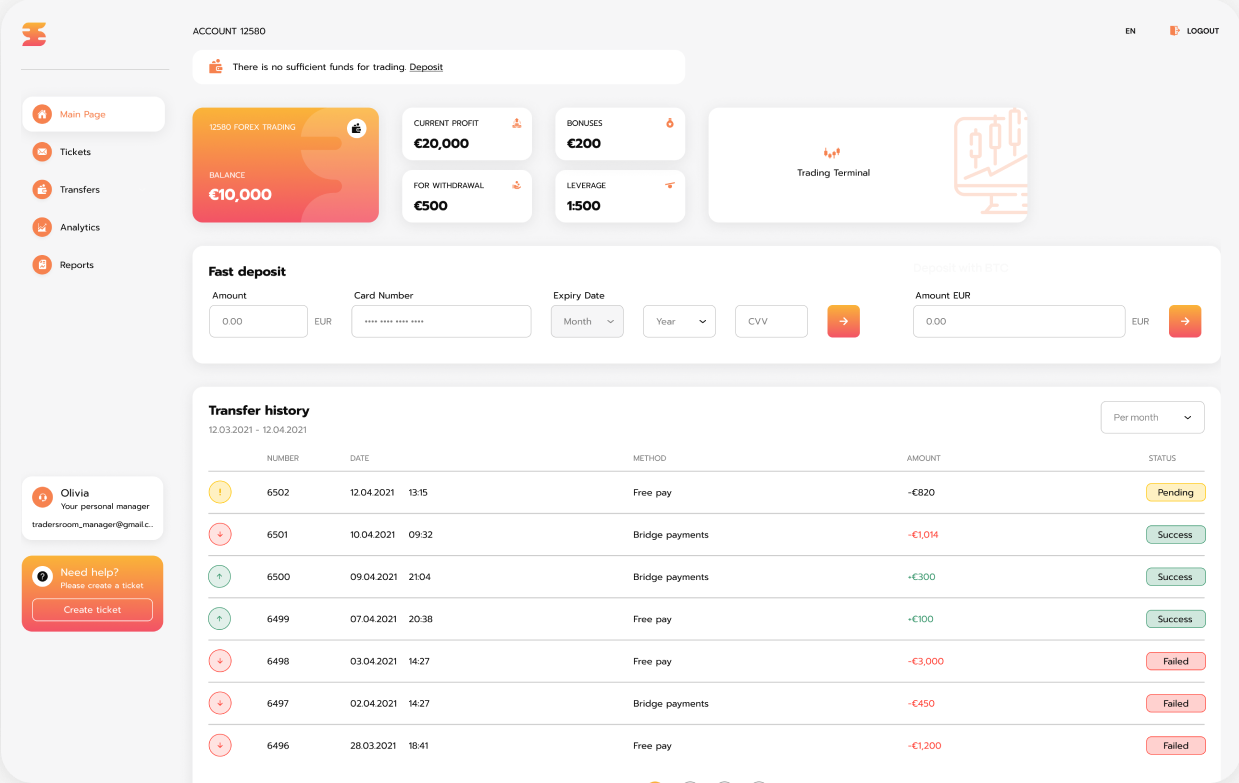

Custom reports

Personalized Reports Customized for Your Needs

Every trader has unique requirements for analyzing and monitoring their trading activity. That's why our company provides customized reports specifically tailored to each client's needs. Our team of professionals works closely with traders to create personalized reports that highlight performance metrics, market analysis or visualization of specific data.

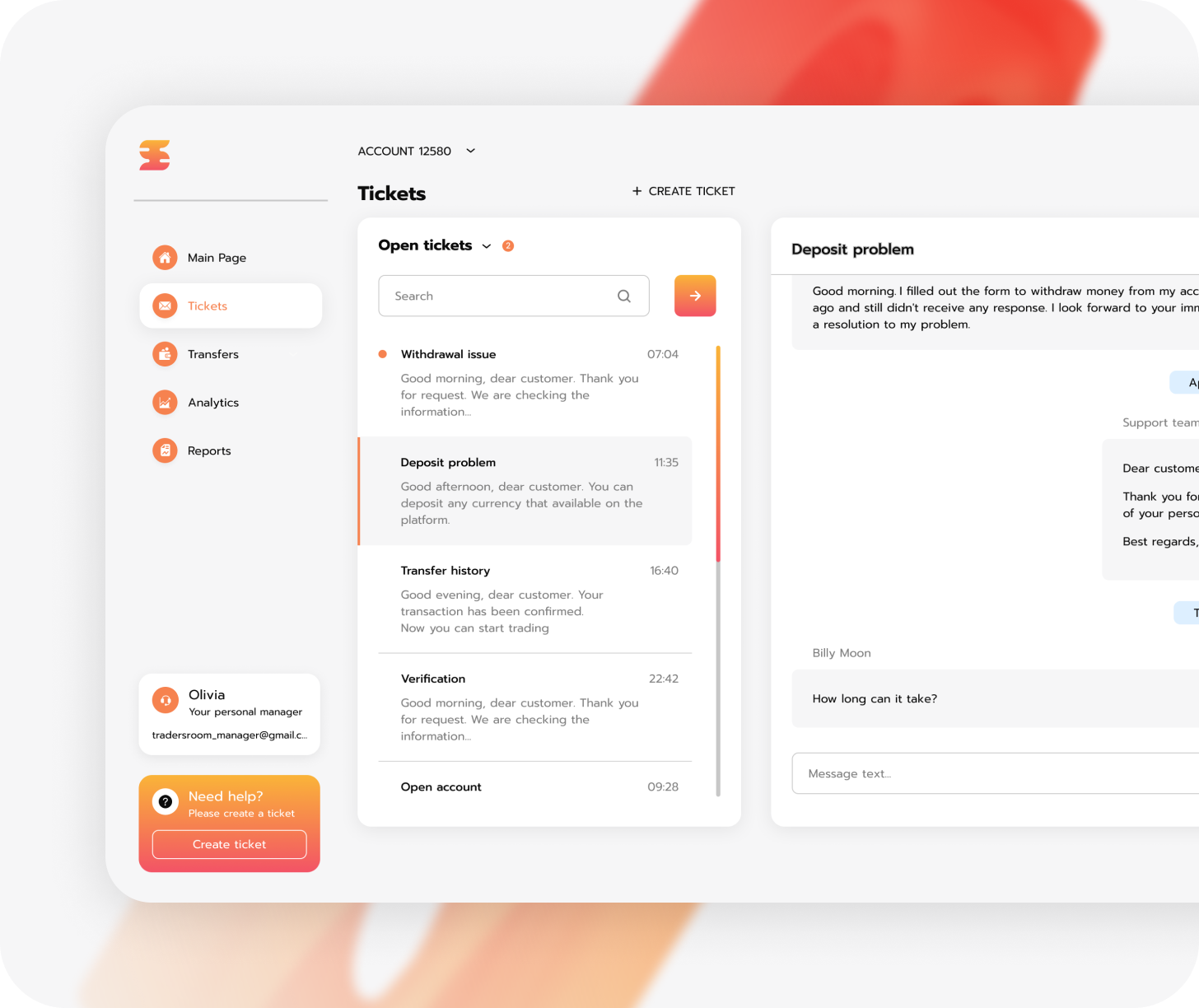

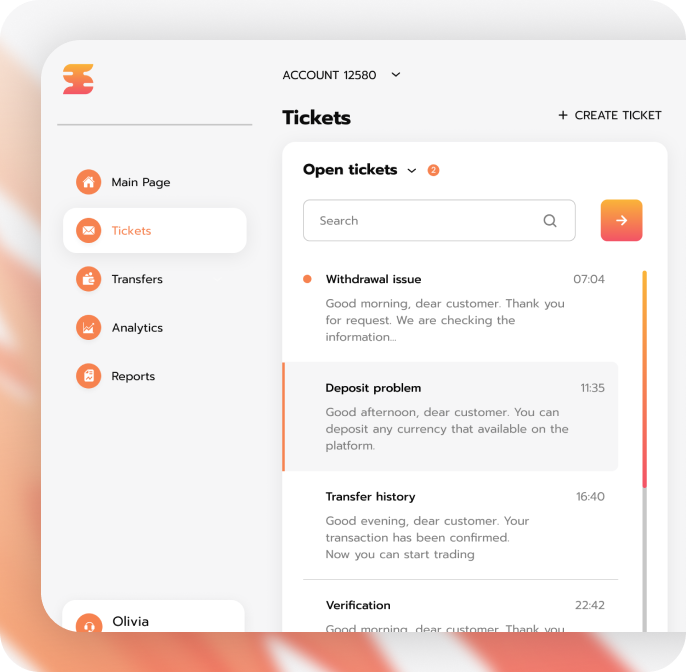

Personalized support

Comprehensive Support Service for Every Trader

Our company prioritizes effective communication with clients, providing a professional support service to address all financial inquiries related to trading. Our team of experts is always available to assist with any questions and ensure seamless trading experiences.

News

Stay Up to Date With the Trends and Happenings

07.01.2026

ALGO Price Prediction: Targeting $0.16-$0.19 by February 2026 as Technical Indicators Signal Bullish Momentum

Exploring Bullish Prospects for Algorand (ALGO): A Comprehensive Technical Analysis

Algorand (ALGO) is currently exhibiting promising technical signals that align with a bullish outlook, suggesting potential price advancement in the near term. At a trading price of $0.14, ALGO is garnering attention for its strong momentum indicators that converge on optimistic short to medium-term forecasts, promising lucrative returns for strategic traders.

Bullish Targets and Support Levels for Algorand

In the short term, over the next week, ALGO aims for a target price of $0.15, indicating a potential rise of 7.1% from its current levels. For the medium-term forecast, spanning one month, potential upsides target the $0.16-$0.19 range, marking an encouraging 14% to 36% increase. Crucially, ALGO must breach the $0.16 resistance to sustain its bullish momentum, while the critical support stands at $0.11, a level of strong confluence should bearish trends emerge.

Analyst Consensus and Projections

An intriguing alignment among multiple analysts strengthens the medium-term bullish narrative for Algorand. CoinDataFlow suggests a conservative long-term target of $0.147855, based on 22 bullish indicators outweighing 13 bearish ones. More aggressive projections from Blockchain.News set sights on the $0.16-$0.19 range, influenced by MACD momentum moving from oversold conditions. AInvest's analysis supports this view, with targets between $0.14 and $0.16 underpinned by MACD divergence and RSI neutrality. Noteworthy, however, is CoinLore's contrarian stance with a bold long-term target of $3.63, though this forecast appears optimistic given current technical conditions.

Current Technical Signals for Algorand

Technical analysis currently positions Algorand for potential upward movement. A MACD histogram reading of 0.0040 is indicative of strengthening bullish momentum, complemented by an RSI at 66.09 that remains neutral, offering room for climbing before crossing into overbought territories. ALGO is challenging resistance at its Bollinger Bands' upper boundary at 1.06, without yet hitting the parabolic moves that often indicate exhaustion. Price actions above short-term moving averages (SMA 7, SMA 20, SMA 50) reaffirm the bullish trend, although the significant resistance posed by SMA 200 at $0.20 remains noteworthy.

Volume and Stochastic Indicators

Volume analysis from Binance reflects $4.96 million in 24-hour trading, ensuring sufficient liquidity for current price actions. On shorter timeframes, Stochastic indicators (%K at 91.35, %D at 92.92) suggest overbought conditions, which could foresee minor consolidations prior to further upward movement.

Key Resistance and Risk Levels

The essential price target for ALGO stands at $0.16, a significant resistance level required for sustained bullish progression. Clearing this threshold, coupled with confirmed volume, could pave the way to the next target at $0.19 with a potential 36% upside. Achieving this scenario demands persistent MACD bullish momentum with RSI remaining below 80 to avoid exhaustion. The ultimate bullish ambition of $0.20, around the SMA 200, signifies major resistance where surpassing it could herald a trend reversal toward $0.32, its 52-week high.

Strategic Positioning and Risk Management

For traders, the foundation of success lies in strategic positioning. A strategic buy approach is advisable, preferably on pullbacks towards $0.13 (SMA 7 support) with a prudent stop-loss below $0.12. More aggressive investments at the current $0.14 offer reasonable risk-reward offerings, whereas conservative traders are advised to await a successful breakthrough above $0.16 accompanied by volume confirmation.

Risk management is pivotal due to ALGO’s proximity to resistance. Stop-loss placements below the $0.12 mark serve to mitigate risks, while profit targets may be strategically scaled at $0.16 and $0.19. Position sizes warrant cautious consideration, potentially forming 2-3% of one's crypto portfolio as opposed to full-scale investments.

Conclusion: The Path Ahead for Algorand

With a balanced technical analysis, Algorand presently supports a bullish price projection of medium confidence spanning the forthcoming 4-6 weeks. The convergence of analysis around the $0.16-$0.19 range, combined with favorable MACD signals and neutral RSI levels, provides a compelling risk-reward landscape. Close monitoring of key indicators such as MACD histogram, RSI levels, and volume on breakout attempts will be critical in confirming predictions.

Given the potential for volatility, traders should remain adaptable and recalibrate their strategies based on evolving technical indicators, with a timeline for this forecast potentially unfolding by February 2026. The first targets might be achieved within 2-3 weeks, should momentum retain its current trajectory.

05.01.2026

10 Best Cryptocurrency Trading Platforms and Brokers (2025)

10 Best Cryptocurrency Trading Platforms Revealed

Cryptocurrency trading has become an increasingly popular investment avenue in recent years. With a multitude of digital assets such as Bitcoin and Ethereum leading the charge, traders globally, including in South Africa, are seeking reliable platforms to engage in this exciting market. The following are some of the top-rated cryptocurrency trading exchanges and platforms that are popular among South African traders for their safety, low costs, and the variety of trading options they provide.

Understanding Cryptocurrency Trading

Cryptocurrency trading entails the buying and selling of cryptocurrencies with the intention of making a profit. Unlike traditional markets, the cryptocurrency market operates 24 hours a day, allowing traders to buy, sell, and trade cryptocurrencies like Bitcoin, Ethereum, and many others at any time. This is facilitated through online platforms known as cryptocurrency exchanges, where users can convert cryptocurrencies into other digital assets or traditional currencies like USD or EUR.

eToro: A Blend of Social Trading and Extensive Offerings

eToro stands out due to its unique blend of social trading features, extensive cryptocurrency offerings, and comprehensive educational resources. It is particularly appealing to South African traders looking for a robust trading platform. South African users can access a range of trading options including cryptocurrencies, stocks, ETFs, and options. However, it is important to note that eToro charges a withdrawal fee that varies based on the method used, and transactions in ZAR (South African Rand) incur currency conversion fees.

Swissquote: Advanced Trading Tools and Security

The Swissquote mobile app enhances trading accessibility by providing real-time market data, advanced charting tools, and seamless trade execution capabilities on the go. Swissquote offers trading on 52 cryptocurrencies including the likes of Bitcoin and Ethereum, through its proprietary platform SQX. To further secure clients' digital assets, Swissquote applies quarterly custody fees and utilizes advanced custody solutions.

Eightcap: Security and Variety for South African Traders

Regulated by reputable bodies such as ASIC, FCA, and CySEC, Eightcap offers peace of mind for South African traders regarding security and compliance. It provides access to more than 100 cryptocurrency CFDs with leverage up to 1:500 and does not charge deposit or withdrawal fees. The platform’s minimum deposit requirement is $100, allowing traders to begin with a low initial investment.

XTB: For Novices and Experienced Traders Alike

XTB is equipped with extensive educational resources and market analysis tools, making it an ideal choice for both novice and experienced cryptocurrency traders. South African traders have access to over 10 cryptocurrency CFDs, including popular currencies such as Bitcoin and Ethereum, with leverage options of up to 1:2. XTB operates under the regulation of the South African Financial Sector Conduct Authority (FSCA), ensuring compliance with local laws.

XM: Cryptocurrency Trading with Comprehensive Resources

XM is known for ensuring client safety with features like negative balance protection. It offers a broad range of educational resources including webinars and tutorials, which are invaluable for traders. South African clients can engage in cryptocurrency trading with access to numerous crypto CFDs with competitive spreads, using MetaTrader 4 and MetaTrader 5 platforms.

Octa: Variety and Accessibility

Octa provides various payment methods for deposits and withdrawals, which include credit cards, electronic payment methods, bank wire transfers, and local transfers. With access to up to 34 cryptocurrency CFDs including Bitcoin, Ethereum, and Litecoin on platforms like OctaTrader, MT4, and MT5, it offers flexibility and accessibility for new traders who can start trading with just $100.

IC Markets: High Security and Low Fees

IC Markets is lauded for its security, being regulated by top-tier financial authorities, and its transparency in pricing combined with low fees. South African clients can trade a variety of crypto CFDs under favorable trading conditions, with a minimum account deposit requirement of $200 or the equivalent in ZAR.

HF Markets: Competitive Spreads and Diverse Account Types

HF Markets offers a secure trading environment regulated by several financial authorities. It provides competitive spreads and a range of account types, including swap-free accounts suitable for Islamic traders. South African clients can engage in cryptocurrency trading with access to an array of crypto CFDs and competitive conditions.

FBS and easyMarkets: User-Friendly Platforms

FBS offers trading on popular platforms like MetaTrader 4 and MetaTrader 5, facilitating a user-friendly experience for South African traders. easyMarkets combines regulatory compliance with intuitive features and robust trading tools, offering cryptocurrency CFDs like Bitcoin, Ethereum, and Ripple, all with a low minimum deposit requirement of $25.

Local Platforms: Luno, VALR, Binance, and Coinbase

Luno, VALR, Binance, and Coinbase are trusted names among South African cryptocurrency trading platforms. They offer secure trading, support for a wide array of cryptocurrencies, and local deposit methods such as EFT (Electronic Funds Transfer) and bank cards. Regulated under the scrutiny of the Financial Sector Conduct Authority (FSCA), these platforms promise transparency, lower trading fees, and user-friendly experiences, especially for beginners like Luno.

Regulations and Compliance: A Secure Trading Environment

In South Africa, cryptocurrency trading is legal and regulated to enhance transparency and protect investors. Most platforms require compliance with local regulations, including FICA, which mandates traders to complete identity verification processes. Furthermore, the South African Revenue Service (SARS) requires the declaration of any profits made from cryptocurrency to ensure tax compliance.

02.01.2026

Coinbase-backed exchange users report sudden withdrawal problems

The Emergent Issue on Lighter Platform Amidst Token Launch

In an intriguing turn of events, users of the innovative cryptocurrency trading platform, Lighter, have found themselves unable to withdraw funds as of December 30, according to reports from Wu Blockchain. This development coincides with the much-anticipated debut of Lighter's native token. While the platform's new asset was expected to streamline transactions and infuse fresh energy into its operations, a technical snag appears to have cast a shadow over its inaugural day.

Lighter's Platform: A Decentralized Crypto Trading Ground

Lighter stands as a beacon of next-gen cryptocurrency trading platforms, backed by renowned investors like Coinbase (Nasdaq: COIN) and Robinhood (Nasdaq: HOOD). This layer-2 decentralized crypto trading hub, built on the robust Ethereum (ETH) blockchain, epitomizes innovation. Unlike traditional systems, Lighter’s decentralized framework means transactions occur independent of a centralized authority, a feature that empowers users by providing control and transparency.

The platform's zero-knowledge (ZK) infrastructure underlines its commitment to security and privacy. By allowing transactions to occur without divulging sensitive financial details, Lighter ensures that users can engage in digital asset transfers with peace of mind, shielded from potential vulnerabilities.

The LIT Token: Bridging Traditional and Decentralized Finance

The launch of Lighter’s native token, Lighter Infrastructure Token (LIT), marks a milestone intended to marry the worlds of traditional finance and decentralized finance (DeFi). The allocation of the LIT token reveals a strategic distribution: 50% directed towards the ecosystem, 26% reserved for the team, and 24% allocated to investors. This structured division aims to foster growth, innovation, and stability within the Lighter ecosystem.

The initial airdrop mechanism converts participants' accrued network points into LIT tokens, ensuring that early adopters are integrated into the platform’s evolution. Holders of LIT tokens enjoy access to financial tools capable of generating risk-adjusted returns and enhancing execution and capital efficiency, ostensibly offering a comprehensive suite of financial benefits.

Price Volatility and the Unforeseen Withdrawal Complication

On its debut, the LIT token soared to an impressive pinnacle of $4.04, only to retreat to $2.77 — a decline surpassing 30% from its record high. While such volatility is not uncommon in the crypto realm, the simultaneity with technical issues exacerbates concerns among investors and users.

Amidst the excitement of LIT's launch, users on the Lighter platform experienced setbacks as they encountered error messages impeding fund withdrawals, specifically noting "Too many L2 Withdrawals". This unforeseen issue, characterized by user frustrations on social platforms such as Lighter’s Telegram support group, sparked debate and concern within the crypto community.

According to Wu Blockchain, this predicament could be linked to a deceleration in block processing speeds. As Lighter addresses these technical hiccups, the importance of robust infrastructure and swift resolution becomes paramount to maintain trust and ensure smooth platform operations.

Awaiting an Official Response

The situation has prompted inquiries from concerned parties and a reach out for official commentary from Lighter’s representatives. Transparency and prompt communication will be crucial in assuaging user apprehension and maintaining the platform's reputation. As the financial markets watch closely, updates from Lighter and the resolution of this issue remain highly anticipated.

31.12.2025

MEXC launches AI copy trading featuring top AI models such as DeepSeek and ChatGPT

Introduction to the AI-Masters Copy Trading Competition

MEXC, a leading global cryptocurrency exchange, has announced the official launch of the "AI-Masters Copy Trading" competition. This groundbreaking event aims to revolutionize the trading landscape by integrating advanced artificial intelligence (AI) technology with the cryptocurrency trading experience. The competition, which runs from December 30, 2025, to January 13, 2026, showcases six prominent AI models in a dynamic 14-day live trading event. These include DeepSeek, ChatGPT, Gemini, Qwen, Claude, and Grok, alongside two enigmatic human traders, creating a captivating tournament that promises to deliver excitement and insight to participants.

Interactive and Seamless Trading Experience

The AI-Masters Copy Trading competition provides users with the unique opportunity to witness high-stakes trading in real-time while offering effortless participation through one-click copy trading. This seamless integration allows users to replicate the trading strategies of top-performing AI models, making it possible for both novice and seasoned traders to engage with sophisticated trading techniques without the need for extensive market analysis.

Diverse Trading Strategies and Opportunities

The six AI models participating in the competition each employ distinct algorithmic strategies, ranging from short-term arbitrage to cyclical and stable growth approaches. This variety demonstrates the breadth of trading methodologies available to participants and provides a rich learning experience. Furthermore, the addition of two mysterious traders introduces unique strategies that offer additional insights and observation opportunities for users.

Forward and Reverse Copy Trading Features

MEXC has enhanced the trading experience by supporting both forward and reverse copy trading in this event. By enabling users to replicate the profitable strategies of the AI models or opt for reverse copying underperforming or specific strategy models, MEXC allows participants to capitalize on opportunities from both sides of the market. This innovative feature expands strategic options, offering flexible allocation in rising and falling markets, thus accommodating investors with varying risk preferences.

Incentive Structure and Reward Pool

To encourage broad participation and engagement, MEXC has set up a total reward pool of 20,000 USDT accompanied by a dual incentive mechanism. This initiative is designed to invite more users to experience the cutting-edge excitement of AI-driven trading, bridging the gap between retail and professional traders and promoting inclusivity and democratization within the crypto trading sphere.

Official Commentary and Industry Impact

As per MEXC Chief Operating Officer Vugar Usi, "Rapid advancements in AI technology are bringing new possibilities for cryptocurrency trading. With this challenge, we aim to help ordinary users efficiently access top-tier AI strategies, narrowing the gap between retail and professional traders, and further promoting the democratization and inclusivity of crypto trading." This statement underscores MEXC's commitment to leveraging AI innovation to enhance trading accessibility and efficiency.

Accessibility and User Engagement

The AI Copy Trading Challenge not only showcases MEXC's innovative application of AI technology but also highlights the exchange's dedication to providing an accessible and efficient trading experience. Users are encouraged to join the challenge, where they can view real-time performance metrics of the participating AI models. Additional information is available on the official MEXC event page, ensuring that all interested parties can become part of this pioneering event.

About MEXC Exchange

Established in 2018, MEXC is committed to being "Your Easiest Way to Crypto." With a service footprint across over 170 countries and regions, MEXC supports more than 40 million users globally. The exchange is renowned for its broad selection of trending tokens, daily airdrop opportunities, and competitive trading fees. Designed to meet the needs of both new traders and seasoned investors, MEXC ensures secure and efficient access to digital assets. Focusing on simplicity and innovation, MEXC continues to make cryptocurrency trading more accessible and rewarding for all users.